Securing your wealth is a crucial step towards living a rewarding life. Financial literacy empowers you with the tools to make smart moves about your earnings and expenses. Gaining control over your finances can dramatically alter your overall quality of life.

- Expense tracking is a fundamental practice that involves systematically evaluating your income and expenses.

- Saving for both immediate needs and future dreams is essential.

- Investing can help you achieve financial independence.

Embracing conscious consumerism are key principles that contribute to long-term wealth creation.

Mastering Money

Taking control of your finances can seem daunting, but creating a budget is the primary step towards achieving financial stability. A well-crafted budget permits you to track your income and expenses, identifying areas where you can save. By distributing funds to crucial needs and aspirational goals, you can endeavor for a more secure financial outlook.

- Begin by listing your income sources and monthly expenses.

- Classify your expenses into needs and aspirations.

- Set realistic reserve goals.

- Analyze your budget consistently to make adjustments.

Remember, budgeting is not about restricting yourself, but about creating conscious monetary choices that match with your beliefs. By adopting these strategies, you can take control of your finances and work towards a more thriving future.

Building Wealth for the Future

Securing your wealth accumulation requires a strategic approach to fund management. Begin by creating clear objectives and conduct thorough research on various strategies. check here A well-allocated portfolio can mitigate volatility, while a long-term perspective allows your investments to compound over time. Collaborate with a qualified wealth manager to personalize your strategy and navigate the complexities of the financial market.

Debt Management Strategies: Get Out of Debt and Stay There

Climbing out of debt can feel like an uphill battle, but with the proper strategies in place, you can regain control of your finances and pave the way for a brighter future. Begin by evaluating your current debt situation, recognizing sources of income and expenses, and creating a achievable budget that prioritizes on debt repayment.

- Investigate combination options to lower your interest rates and streamline payments.

- Discuss with creditors to potentially secure more lenient terms.

- Build healthy financial behaviors by observing your spending, saving consistently, and resisting new debt accumulation.

Keep in mind that getting out of debt is a journey that demands patience, discipline, and a consistent effort. Consult professional guidance from financial advisors or credit counselors if you deserve additional support.

Building Your Wealth : Reach Your Goals Faster

Want to see your financial plan grow faster? It's all about smart saving. First, develop a budget that tracks your revenue and expenses. Then, identify areas where you can reduce your spending without neglecting the things that bring you joy. Consider programming your savings to a separate account to ensure consistent growth. Lastly, research different accumulation options that align with your risk tolerance. Remember, saving smart is a journey that requires dedication but the payoffs are well worth it.

Protecting Your Assets: Insurance and Financial Planning

Planning for your future is a crucial step in securing financial well-being. A well-crafted plan encompasses multiple key factors: insurance to mitigate unexpected situations and financial planning to maximize your wealth.

- Accumulating in a strategic portfolio can help your money appreciate over time.

- Assessing your insurance coverage regularly ensures it addresses your present needs.

- A experienced financial consultant can provide personalized guidance to assist you in creating a plan that reflects your objectives.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Mike Vitar Then & Now!

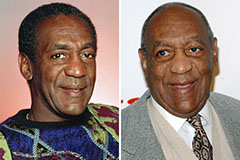

Mike Vitar Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!